Kevin Gray

Chief Investment Officer

![]() 5 min read

5 min read

Definitely Maybe Heading for an Inflation Supernova

Definitely Maybe Heading for an Inflation Supernova

‘We have gold because we cannot trust governments.’ – Herbert Hoover

‘Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get

for five dollars when you had hair.’ – Sam Ewing

‘Sorry Vern. I guess a more experienced shopper could have gotten more for your

seven cents.’ – Gordie, Stand By Me

‘Freddos.’ – anon

There are three levels of monetary policy:

1. Interest rate changes

2. Quantitative Easing

The second level is asset purchases (QE), made popular by Ben Bernanke post-GFC. A popular school of thought at the time was that QE had to be inflationary, but inflation has failed to materialise, leading to a more modern, more dangerous school of thought that QE is in fact not inflationary; money printer goes brrr, stocks go up, inflation stays low – into perpetuity.

However, in order for QE to be inflationary, it must first increase the money supply. This might seem an obvious point as ‘that’s what QE does, right?’

Not necessarily.

The difference with the QE of the western world post-GFC, and Japan long before that, is that they did not increase the money supply, and therefore were not inflationary. In the aftermath of the GFC, QE was mostly just central banks interacting with commercial banks, this is in effect just an asset swap and has little effect on broad money supply. In order to increase broad money supply, purchases of longer-dated assets are required from non-banks in order to credit bank deposit liabilities i.e. create money.

The GFC was also a huge deflationary shock to the system as the combination of house and asset price falls caused US household net worth to fall off a cliff, and not fully recover for years. The Fed’s increase in its balance sheet in the proceeding years did not even actually offset this loss in net worth to the population. There was no significant money creation, and asset price inflation rather than any consumer price inflation was the result.

So what is different this time?

3. Direct injections of capital into the economy (MMT/Helicopter Money)

This time the Fed and US Government have come together in monetary and fiscal union, and the money is getting to the real economy:

$1,200 direct into bank accounts, unemployment benefit raised by $600 pw – meaning that 80% of the newly unemployed are earning more than when they worked, PPP loans, large corporate bailout packages, the Fed stabilising the junk bond market etc – more stimulus has been provided in three months than in the six years post-GFC, and there is another $2.5trn to come before the election.

Personal income in the US was up YOY through April and May, and asset prices have recovered quickly. There has not been such a loss to net worth, and when added to the fact that monetary and fiscal stimulus dwarfs what we have seen in any prior peacetime period means money supply is increasing, fast.

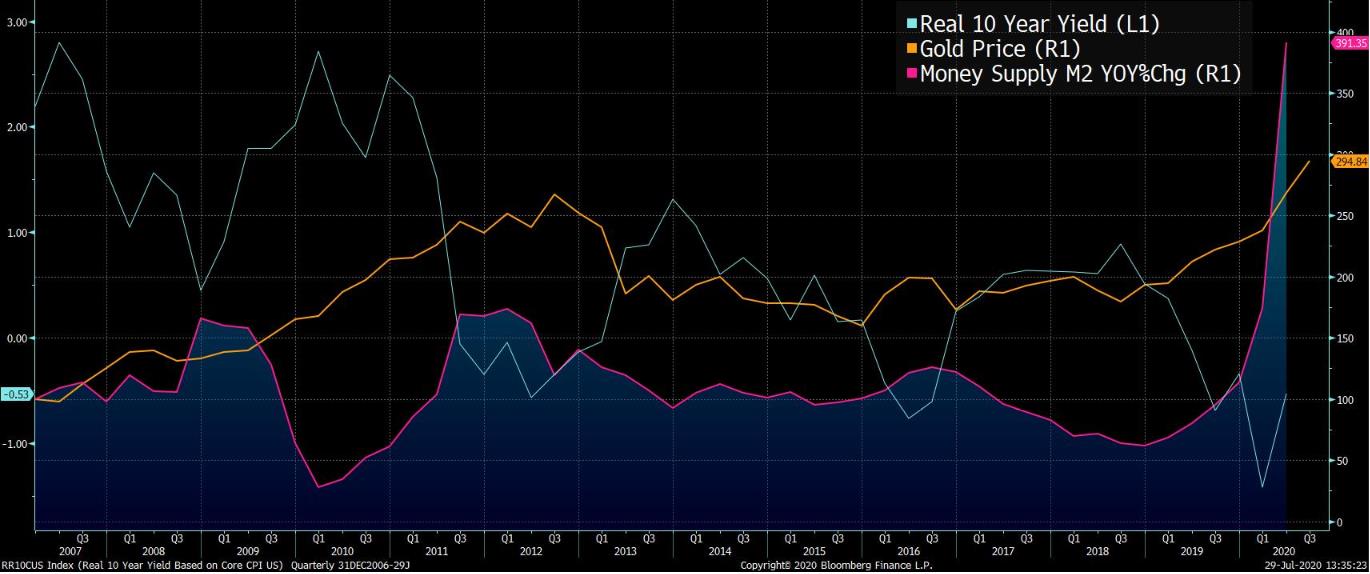

Source: Bloomberg

Neo-Keynesian economists would argue that this increase is still not inflationary with an output gap, there needs to be cost push-from wages, which looks unlikely given employment conditions. One might be forgiven for assuming that the bond market must be exclusively populated by neo-Keynesians, given where yields are trading currently.

Monetarists, on the other hand, see inflation in terms of how much the growth in money supply exceeds the growth in the real level of GDP, in other words whether more money is being created to chase a fairly fixed, or at least slow and linearly growing, amount of goods.

There is now 23% growth in the money supply concurrent with a short term drop in CPI, one is likely to have to give. It should be noted that it is relatively easier to raise prices than to get rid of money, which would require Quantitative Tightening (highly unlikely), or a loan loss collapse larger than 2008.

Is this what is driving gold higher?

Gold does serve as an inflation hedge, but it is slightly more nuanced than that; the gold price is closely linked to real yields in the sense that real yields are an opportunity cost to holding gold, normally.

Into the 2020s huge deficits have been carried, and the Fed have made it very clear that rates are being held at zero for the foreseeable future. The usual opportunity cost of holding gold as an inflation hedge could turn out to be just an opportunity if inflation ticks up and real yields fall further into negative territory. Gold could well have further to run.

Source: Bloomberg

– This document has been issued and approved as a financial promotion by Fortem Capital Limited for the purpose of section 21 of the Financial Services and Markets Acts 2000. Fortem Capital Limited registration number 10042702 is authorised and regulated by the Financial Conduct Authority under firm reference number 755370.

– This document is intended for Professional Investors, Institutional Clients and Advisors and should not be communicated to any other person.

– The information has been prepared solely for information purposes only and is not an offer or solicitation of an offer to buy or sell the product.

– Data is sourced from Fortem Capital Limited and external sources. The data is as at the date of this document and has been reviewed by Fortem Capital Limited.

– Information, including prices, analytical data and opinions contained within this document are believed to be correct, accurate and derived from reliable sources as at the date of the document. However, no representation or warranty, expressed or implied is made as to the correctness, accuracy or validity of such information.

– Fortem Capital Limited assumes no responsibility or

liability for any errors, omissions or inaccuracy with respect to the information contained within this document.

– All price and analytical data included in this document is intended for indicative purposes only and is as at the date of the document.

– The information within this document does not take into account the specific investment objective or financial situation of any person. Investors should refer to the final documentation and any prospectus to ascertain all of the risks and terms associated with these securities and seek independent advice, where necessary, before making any decision to buy or sell.

– The product may not be offered, sold, transferred or delivered directly or indirectly in the United States to, or for the account or benefit of, any U.S. Person.

– The Fortem Capital Progressive Growth Fund is a Sub-Fund of Skyline, an open-ended investment company with variable capital incorporated on 1 June 2010 with limited liability under the laws of Ireland with segregated liability between Funds. The Company is authorised in Ireland by the Central Bank of Ireland pursuant to the UCITS Regulations.

“NOTICE TO INVESTORS DOMICILED OR RESIDENT IN

SWITZERLAND – The interests in the UCITS Fund and any related services, information and opinions described or referenced in this document are not, and may not be, offered or marketed to or directed at persons in Switzerland (a) that do not meet the definition of “qualified investor" pursuant to the Swiss Federal Act on Collective Investment Schemes of 23 June 2006 (“CISA") (“Non-Qualified Investors"), or (b) that are high net worth individuals (including private investment structures established for such high-net worth individuals if they do not have professional treasury operations) that have opted out of customer protection under the Swiss Federal Financial Services Act of 15 June 2018 (“FinSA") and that have elected to be treated as “professional clients" and “qualified investors" under the FinSA and the CISA, respectively (“Elective Qualified Investors").

In particular, none of the information provided in this document should be construed as an offer in Switzerland for the purchase or sale of the interests or any related services, nor as advertising in Switzerland for the interests or any related services, to or directed at Non-Qualified Investors or

Elective Qualified Investors. Circulating or otherwise providing access to this document or offering, advertising or selling the interests or any related services to Non-Qualified Investors or Elective Qualified Investors may trigger, in particular, approval requirements and other regulatory requirements in Switzerland.

This document does not constitute a prospectus pursuant to Articles 35 et seqq. FinSA and may not fulfill the information standards established thereunder. No key information document pursuant to Swiss law has been established for the interests. The interests will not be listed or admitted to trading on a Swiss trading venue and, consequently, the information presented in this document may not fulfill the information standards set out in the relevant trading venue rules."

For more information on the investment philosophy or any of Fortem’s investment offerings, please do not hesitate to contact the team, we would be delighted to hear from you

ABOUT

ABOUT