Kevin Gray

Chief Investment Officer

![]() 5 min read

5 min read

US Income Fund

Passive Aggression Incoming

Over the years, I’ve often been asked for investment advice…my regular recommendation has been a low cost S&P 500 index fund.’

Warren Buffet

‘Don’t look for the needle in the haystack. Just buy the haystack!’

John Bogle

‘I’m living so far beyond my income that we may almost be said to be living apart.’

E. E. Cummings

There are certain debates that are somewhat ever-present in the world of finance. Two that will immediately spring to the mind of most investors would be active vs passive, and value vs growth. These debates, or iterations thereof, have evolved not least in part due to the very public ‘fintwit’ (financial Twitter) arena in which they are now conducted. Twitter undoubtedly brings out the absolute worst in ‘debate’ as only an echo chamber that encourages all of the fallibilities of human psychology can, but it has also likely continued to bring the debate to the forefront for a greater number of investors’ minds.

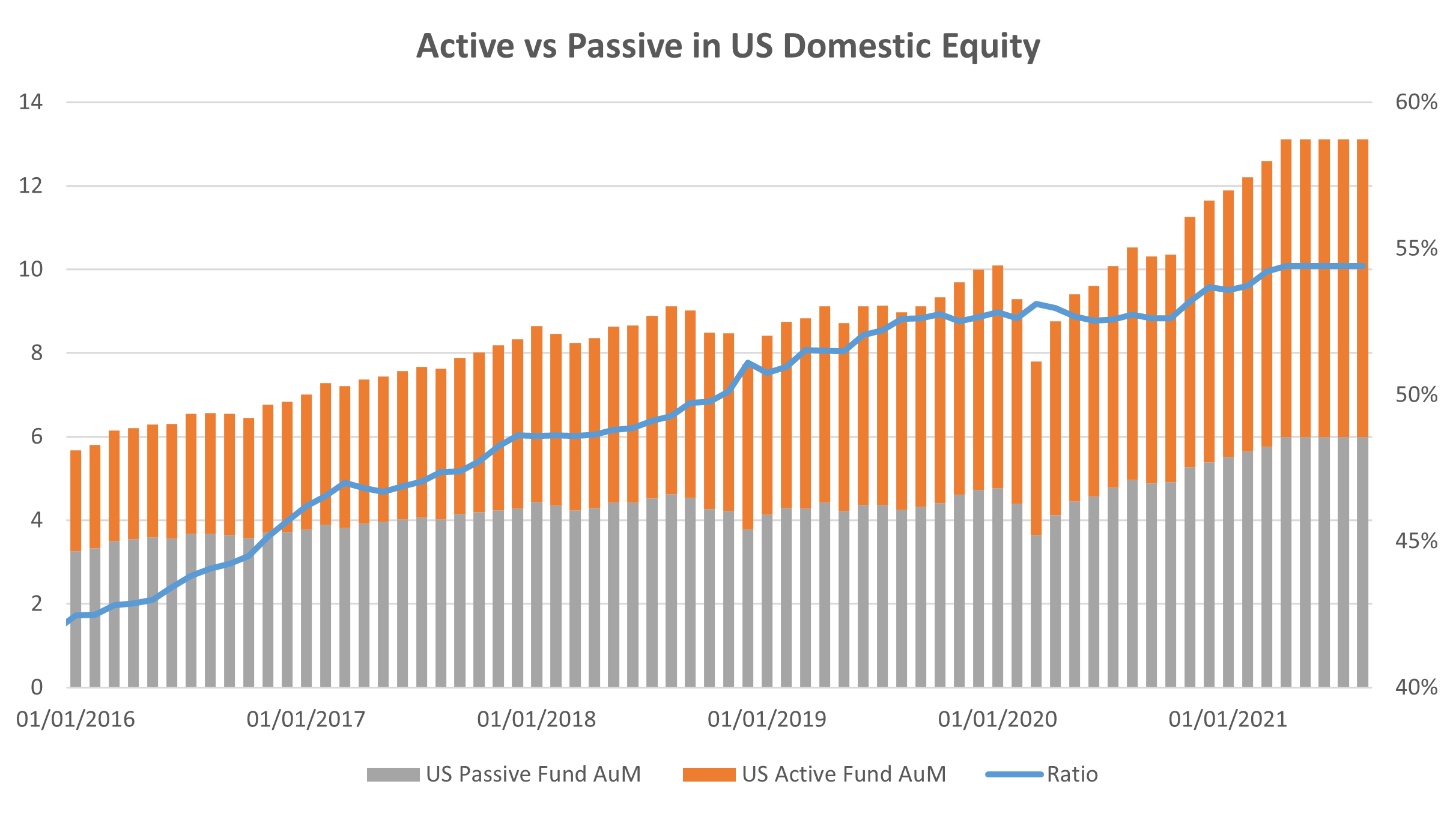

In late 2018 passive investing in US domestic equity overtook active, and has continued to grow that lead since, with its market share now standing at 54%:

Source: Citigroup, Fortem Capital, Bloomberg

The main driver of this has been investors’ preference for funds that track the S&P 500, and the evidence would suggest that they would be right.

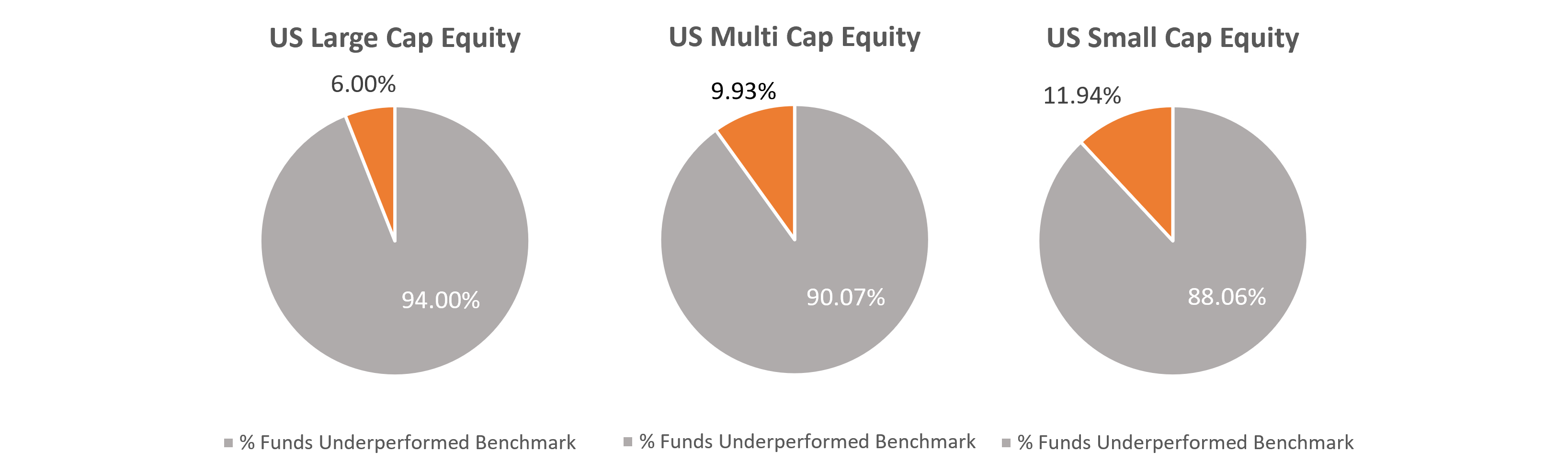

S&P Indices versus Active (SPIVA) scorecards are reports published by S&P Dow Jones that compare the performance of active funds against their benchmarks; they make fairly sobering reading for active equity investment. Unsurprisingly it is the US where active managers struggle most; it is widely accepted that the US large cap equity market is the most efficient in the world, and so would be the most sensible place for passive to dominate first, as it has. The numbers back this up.

Market conditions in 2020 were what most active managers were suggesting were needed for the ‘dumb’ money to look just that. However, in spite of the numerous opportunities for outperformance that the pandemic should theoretically have provided, 57% of domestic US equity funds underperformed the S&P Composite 1500 index in the year, the 11th consecutive year of active underperformance. Larger sample sizes make for even worse reading; in good times as well as bad, active management has consistently underperformed in the US:

SPIVA 2021, Active Funds vs Benchmarks, US Equity (01/01/2001 – 31/12/2020)

To many readers, the above will be nothing new, and indeed the rise in passive investing in US equity is testament to this.

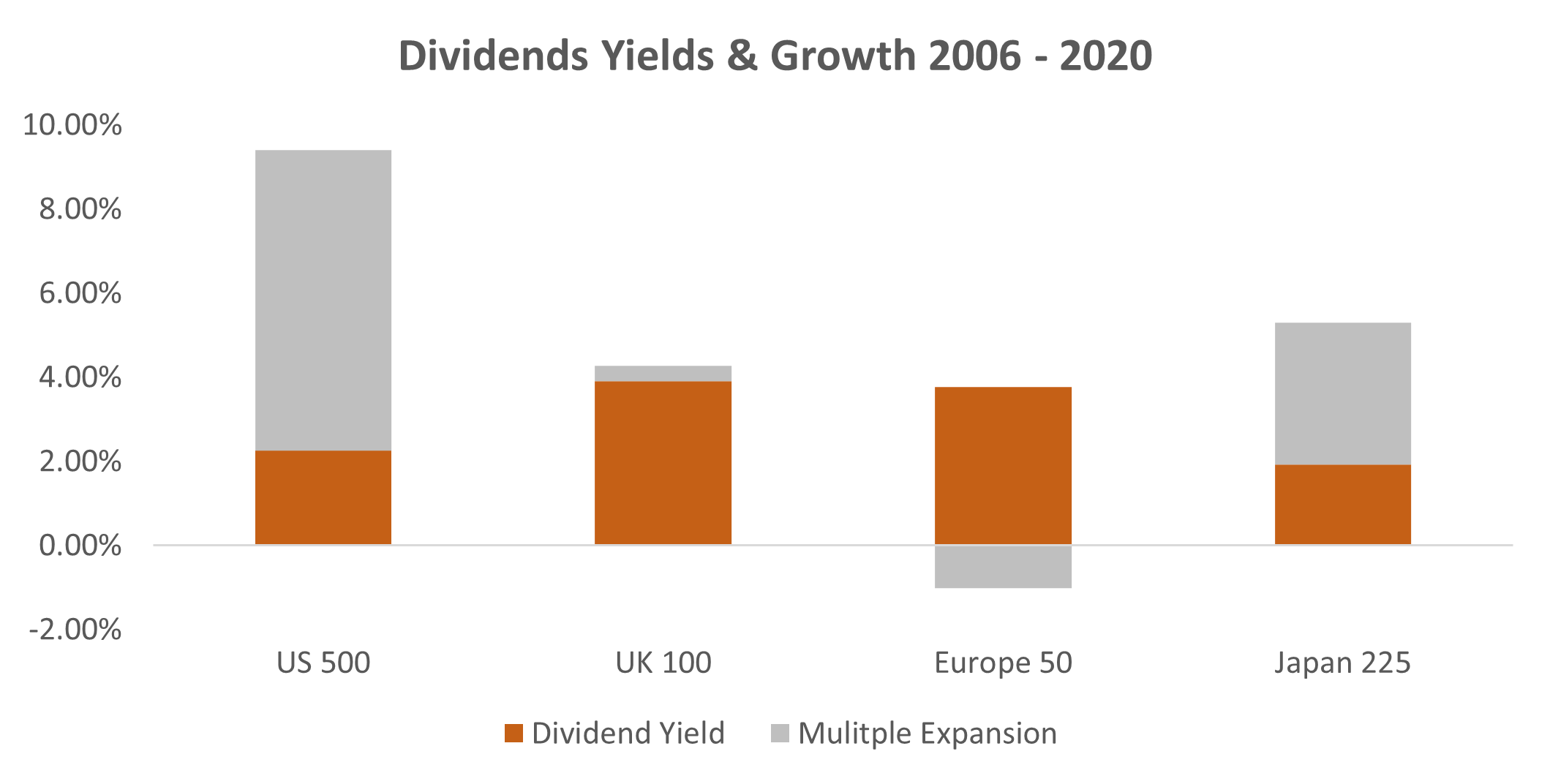

In addition, the major US benchmark index has also enjoyed significant outperformance versus its global peers, driven largely by the heavy weighting to disruptive technology stocks that have become global behemoths (to a staggering extent noted at the end of this piece). For investors looking at fundamentals, for years the technology heavy S&P 500 has provided the growth that has been lacking in the global economy as a whole; while growth is hard to come by, investors are happy to pay a heavy premium for it. And in the absence of significant productivity growth, it may well be the case that the world’s major domestic benchmark equity index continues to outperform.

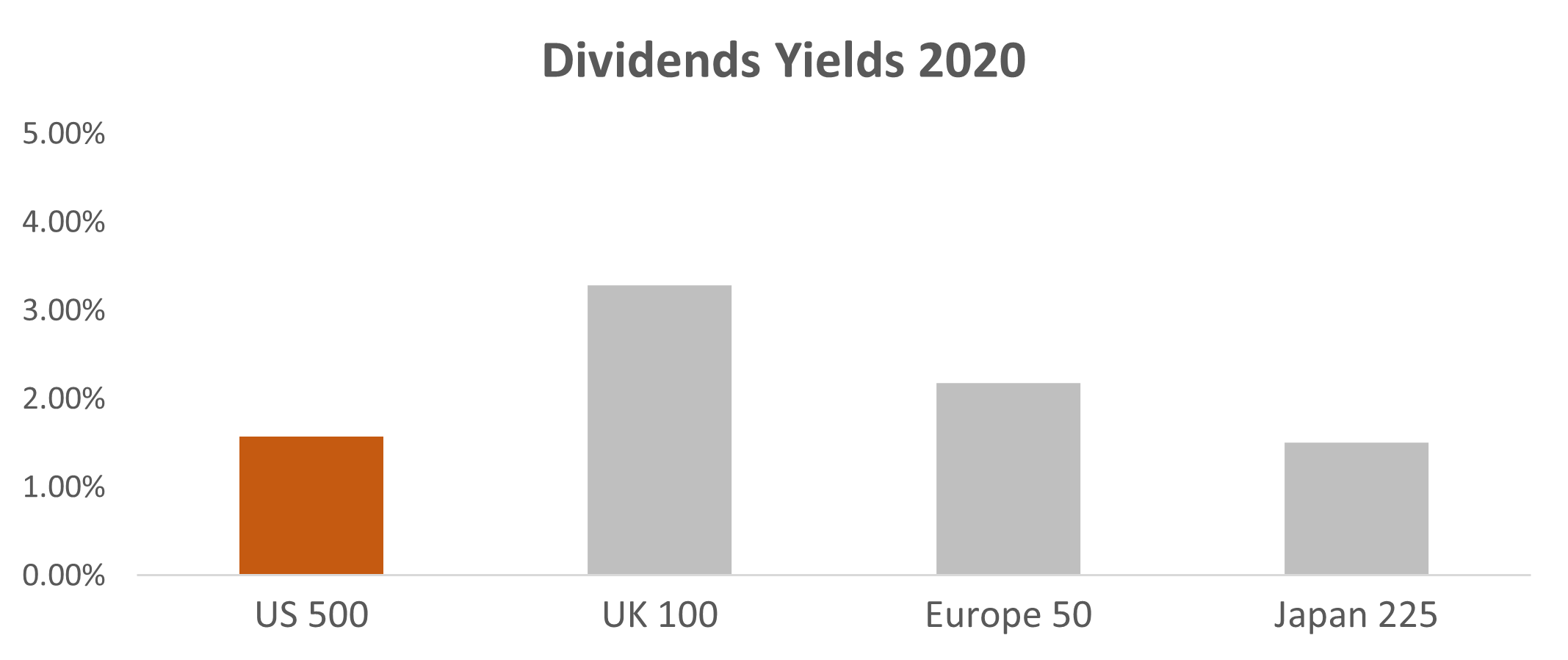

For investors in need of income, this has for some time posed a problem, especially given the meagre yields now available from even the riskiest part of the bond market.

The US equity market has relatively low dividend yields versus its UK and European peers:

Multiple expansion has been the primary driver of returns; investors have paid up for growth where it has existed:

As a result, income mandates have either tended to be structurally underweight US equity due to the low level of income available on the benchmark index, or invest in active funds that target higher dividend paying companies in the US market. And therefore they have tended to underperform substantially.

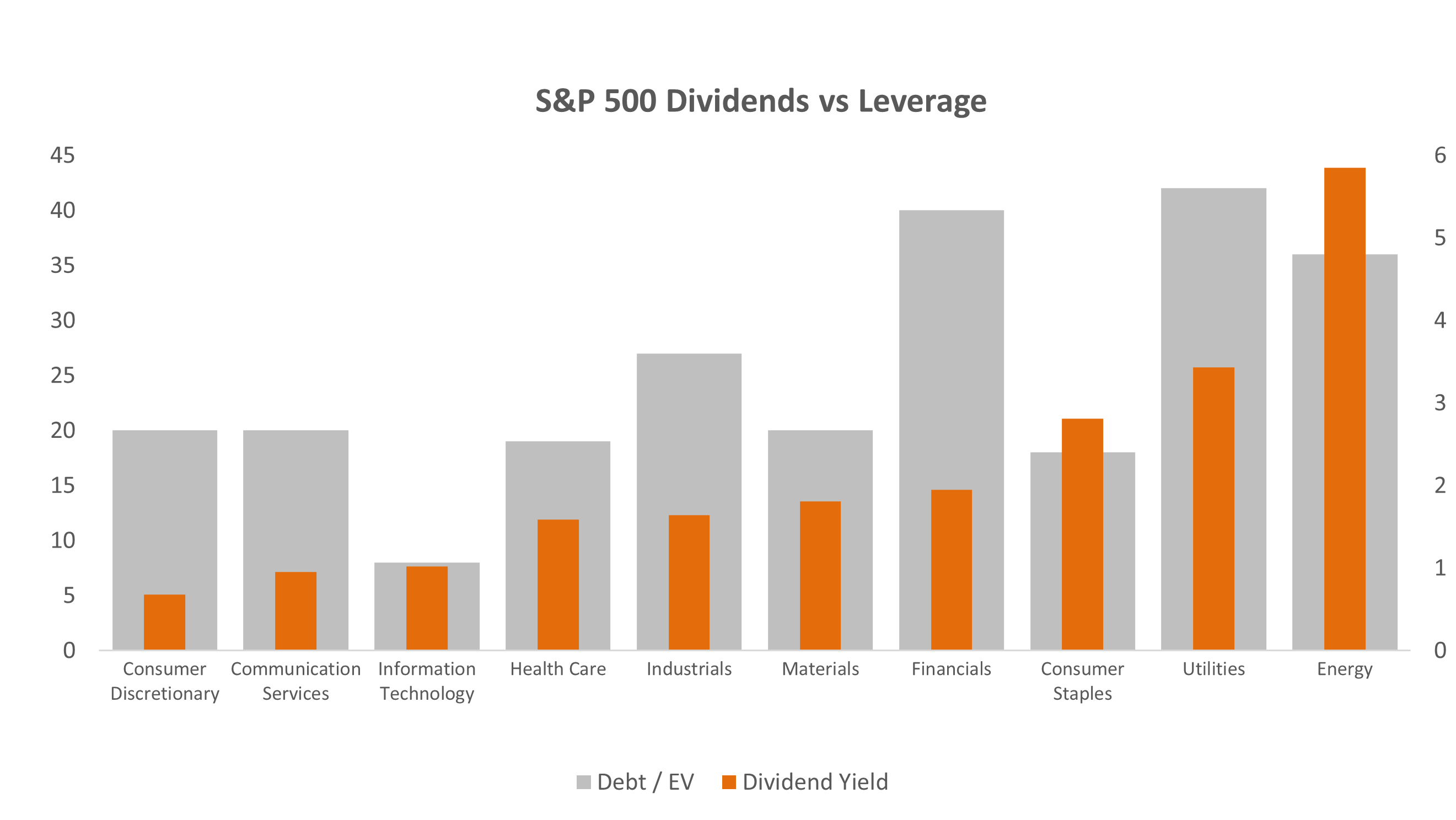

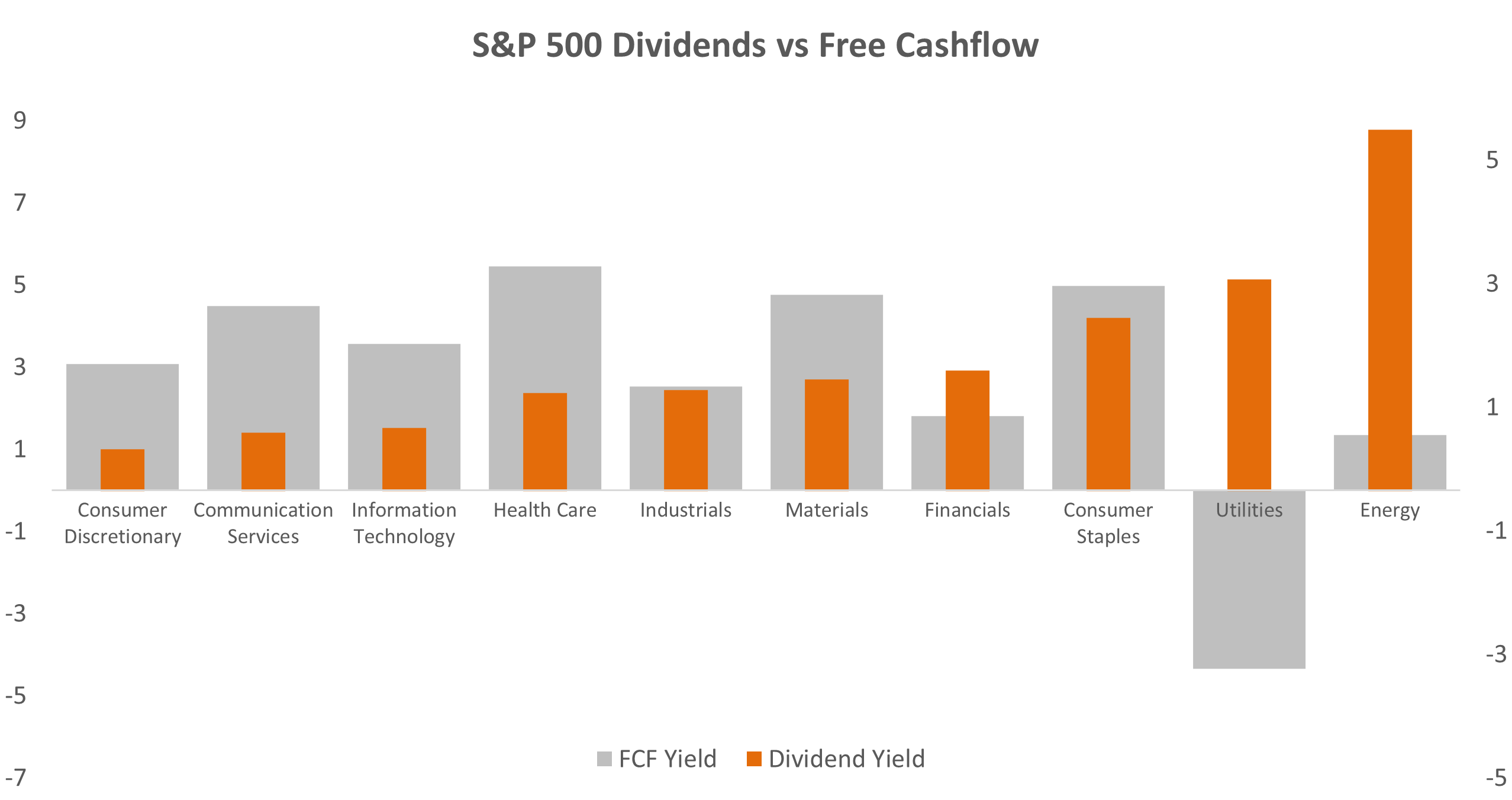

Higher dividend companies are sometimes assumed to be lower risk due to the history of a high dividend imputing financial discipline. However, in the era of free money, US corporates have used leverage to fund share buybacks and dividends; the higher dividend payers are in the parts of the market with poorer quality balance sheets.

As dividends are often not covered by free cashflow, dividend cuts are highly likely in the event of a downturn / recession. During the Global Financial Crisis, few high dividend paying stocks in the US maintained their dividend, and the S&P High Dividend index underperformed the main benchmark index significantly.

Call selling has been used as a solution in order to maintain exposure to the S&P with an enhanced yield. However, with the Fed’s unprecedented intervention into the market suppressing volatility and therefore option prices, the risk of those calls expiring in the money is on average not compensated by the premium raised; traditional naked call selling bleeds heavily in a bull market, and covered call selling locks in underperformance in a bull market.

However, there is a way one can deliver significant income, gross of withholding tax, while tracking the major US benchmark index, allowing income investors and mandates to have a weighting more akin to other clients and mandates of similar risk profile, whilst not eschewing naturally derived and taxed income in order to do so. It requires significant derivative expertise which allows a certain level of financial alchemy.

In May 2021 Fortem Capital launched a Fund looking to do just that, and it is.

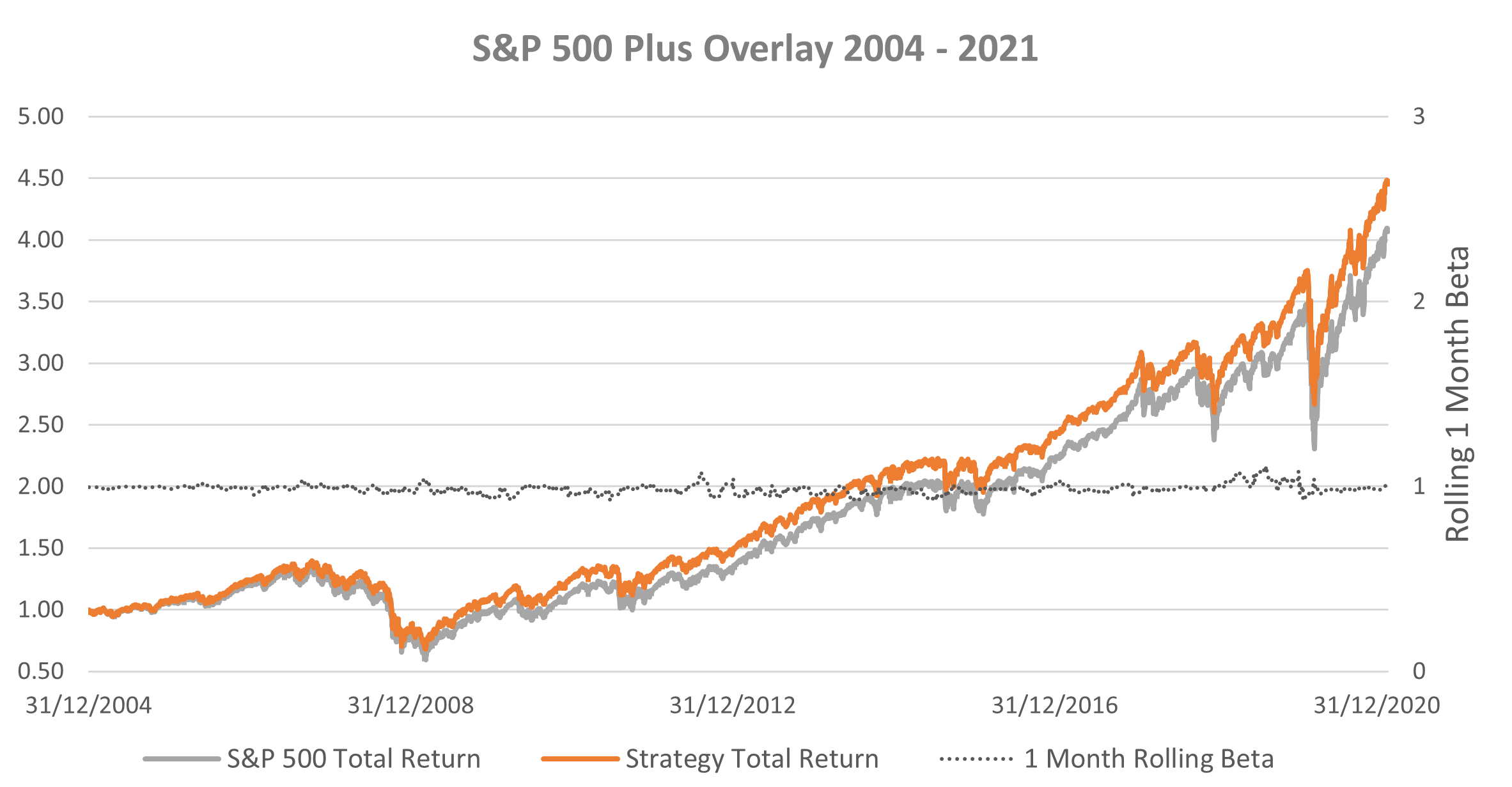

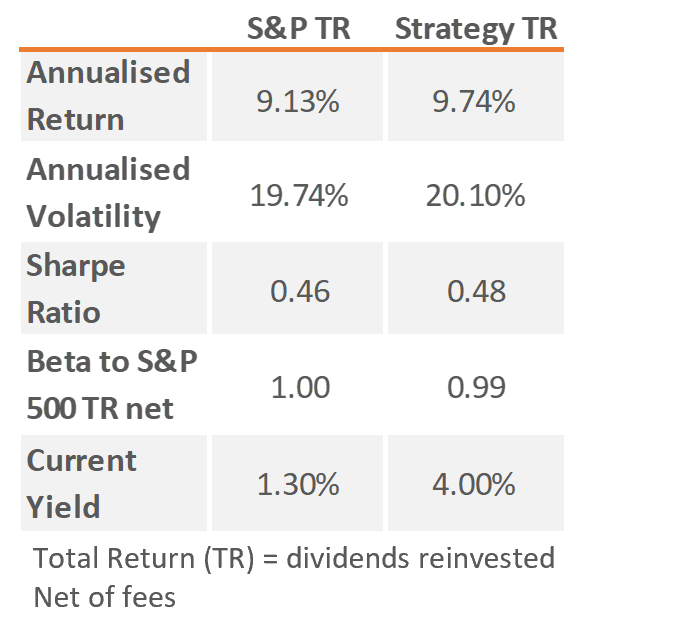

Over a longer period, whilst usual caveats associated with backtests apply, derivatives do give defined payoffs dependent on moves in the underlying:

SIMULATED PAST PERFORMANCE: Past performance data shown in this communication is derived from back-testing simulations. This is provided for illustrative purposes only. Details of the calculation methodology are available on request. Past performance is not necessarily a guide for the future. Forecasts are not reliable indicators of future performance. The value of investments, and the income from them, can go down as well as up and the investor may not get back the amount originally invested. The data is sourced from Fortem Capital Limited and external sources. The data is as at the date of this document and has been reviewed by Fortem Capital Limited.

Data from 31st December 2004 to 31st March 2021

Source: Fortem Capital, Bloomberg

Income investors have become used to compromising where the benchmark US equity index is concerned. In order to maintain a weight commensurate with non-income investors of the same risk profile, they have typically had to either compromise on overall income, or take more risk elsewhere in order to make up the difference, something that has become increasingly risky and difficult as yields and credit spreads have fallen to record lows.

The fact that Apple, Alphabet, Amazon and Facebook are together worth more than the entire Japanese stock market (>$7trn), Apple and Facebook are together worth more than the FTSE, and Amazon is bigger than the DAX on its own, means that any investor that needs to compromise their exposure to these names is taking a risk in of itself, and has likely suffered as a result to date. Whilst it is impossible to tell whether the phenomenal growth that these names and the S&P have enjoyed continues into perpetuity in relative terms, in a low growth environment any companies that do provide meaningful growth are likely to continue to command a premium for it, and with 54% of the market investing passively and growing, the risk of income investors being left further behind is real.

The Fortem Capital US Equity Income Fund allows income investors, or even those in search of a yield pick up without adding duration and credit risk in the fixed income space, to not have to compromise; the Fund aims to track the S&P 500 TR net, whilst providing a dividend yield of 4%.

The Fund launched in May 2021 and is doing exactly that.

To learn more about accessing individual strategies or Fortem Capital funds:

T 020 8050 2900 E sales@fortemcapital.com

– This document has been issued and approved as a financial promotion by Fortem Capital Limited for the purpose of section 21 of the Financial Services and Markets Acts 2000. Fortem Capital Limited registration number 10042702 is authorised and regulated by the Financial Conduct Authority under firm reference number 755370.

– This document is intended for Professional Investors, Institutional Clients and Advisors and should not be communicated to any other person.

– The information has been prepared solely for information purposes only and is not an offer or solicitation of an offer to buy or sell the product.

– Data is sourced from Fortem Capital Limited and external sources. The data is as at the date of this document and has been reviewed by Fortem Capital Limited.

– Information, including prices, analytical data and opinions contained within this document are believed to be correct, accurate and derived from reliable sources as at the date of the document. However, no representation or warranty, expressed or implied is made as to the correctness, accuracy or validity of such information.

– Fortem Capital Limited assumes no responsibility or

liability for any errors, omissions or inaccuracy with respect to the information contained within this document.

– All price and analytical data included in this document is intended for indicative purposes only and is as at the date of the document.

– The information within this document does not take into account the specific investment objective or financial situation of any person. Investors should refer to the final documentation and any prospectus to ascertain all of the risks and terms associated with these securities and seek independent advice, where necessary, before making any decision to buy or sell.

– The product may not be offered, sold, transferred or delivered directly or indirectly in the United States to, or for the account or benefit of, any U.S. Person.

– The Fortem Capital Progressive Growth Fund is a Sub-Fund of Skyline, an open-ended investment company with variable capital incorporated on 1 June 2010 with limited liability under the laws of Ireland with segregated liability between Funds. The Company is authorised in Ireland by the Central Bank of Ireland pursuant to the UCITS Regulations.

“NOTICE TO INVESTORS DOMICILED OR RESIDENT IN

SWITZERLAND – The interests in the UCITS Fund and any related services, information and opinions described or referenced in this document are not, and may not be, offered or marketed to or directed at persons in Switzerland (a) that do not meet the definition of “qualified investor" pursuant to the Swiss Federal Act on Collective Investment Schemes of 23 June 2006 (“CISA") (“Non-Qualified Investors"), or (b) that are high net worth individuals (including private investment structures established for such high-net worth individuals if they do not have professional treasury operations) that have opted out of customer protection under the Swiss Federal Financial Services Act of 15 June 2018 (“FinSA") and that have elected to be treated as “professional clients" and “qualified investors" under the FinSA and the CISA, respectively (“Elective Qualified Investors").

In particular, none of the information provided in this document should be construed as an offer in Switzerland for the purchase or sale of the interests or any related services, nor as advertising in Switzerland for the interests or any related services, to or directed at Non-Qualified Investors or

Elective Qualified Investors. Circulating or otherwise providing access to this document or offering, advertising or selling the interests or any related services to Non-Qualified Investors or Elective Qualified Investors may trigger, in particular, approval requirements and other regulatory requirements in Switzerland.

This document does not constitute a prospectus pursuant to Articles 35 et seqq. FinSA and may not fulfill the information standards established thereunder. No key information document pursuant to Swiss law has been established for the interests. The interests will not be listed or admitted to trading on a Swiss trading venue and, consequently, the information presented in this document may not fulfill the information standards set out in the relevant trading venue rules."

For more information on the investment philosophy or any of Fortem’s investment offerings, please do not hesitate to contact the team, we would be delighted to hear from you

ABOUT

ABOUT